Stocks and mutual funds won’t make you rich. Starting your own business will.

So, I discovered this chart by a post from James Camp, a guy I follow on X, who specializes in “nanoflips.” Check out his bio for info on those.

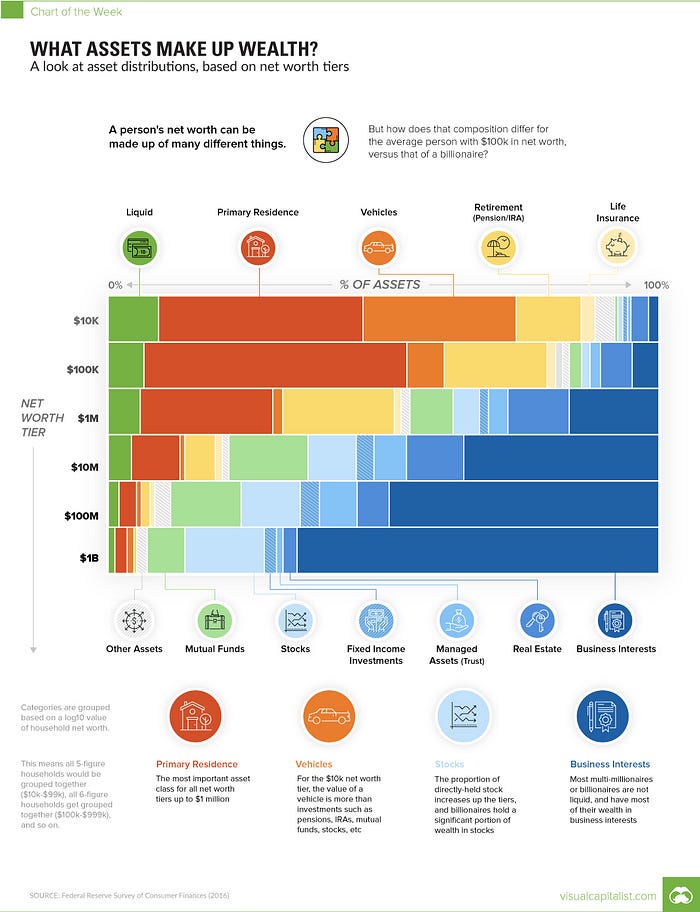

The graph comes from Visual Capitalist, a clever website that takes complex information and distills it into to easy to understand (and colorful) charts.

The chart displayed above is based on a Federal Reserve Survey of Consumer Finances from 2016, and it contains some illuminating aspects about how people in different net worth tiers manage their wealth.

Like many, I’ve always been under the impression that stocks and mutual funds are the best ways to build and maintain wealth for the average person. Over the last few years, I’ve diligently maxed out my 401(k) and IRA funds. I contribute regularly into a personal brokerage account. Even through the Covid Crash and the 2022 drawdown, I kept plugging away, dollar-cost averaging into the market like you “should.”

The returns have been solid, for sure. While I’m not close to retirement anytime soon, I’ve built up a decent net worth. I like to think I’ve “secured the bag.” Meaning that even if I never contributied another dime to my investment accounts from now until age 65, compound growth alone would get me to a comfortable retirement. And that’s NOT taking into account potential Social Security payments.

I say “potential” because who knows if Social Security will exist by then, or pay out what it’s supposed to. It’s never a good idea to bank your life on a government program, especially when the government is over 30 trillion dollars in debt.

However, the above chart has made me completely reevaluate my relationship with invesing and money in general.

For starters, the chart shows that the higher a person’s net worth the more they have invested in “business interests.” These are businesses someone owns personally. They could be anything from a franchise, a laundromat, a service company, all the way up to a controlling stake in a Fortune 500 company.

Elon Musk has a 20.5% stake in Tesla, for example.

What’s surprising, however, is how little percentage-wise wealthy people are invested in stocks and mutual funds relative to their net worth. The chart combines net worths together and works out an average. So in the row where it says $10K, it’s grouping all the people with $10K through $100K together. Then in the $100K row, it’s everyone with a net worth between $100K and a million. So on and so forth.

People in the $1 million to $10 million range look to have close to 40% of their net worth in retirement accounts, stocks, and mutual funds. This makes sense give that most people in that range are retirees who spent years contributing to company 401(k) plans, pensions, and their own IRAs. About 30% of their net worth is in their primary residence.

However, going further up in net worth on the chart shows that the wealthy have increasingly less in stocks and personal homes, and vastly more locked up in their own businesses.

For those in the $10M+ group, stocks are no more than about 30% of their net worth, and their personal homes aren’t even 15%. Their wealth is mainly all in their own businesses.

This may seem obvious. But almost everywhere you turn, you only ever hear about the importance of investing in a diversified portfolio of mutual funds and ETFs.

Dave Ramsey touts mutual funds like a religion to his millions of listeners.

But are index funds and mutual funds really the best ways to build wealth?

If you were to ask most people how they think they can get rich through investing, most would probably say by getting lucky on a stock or cryptocurrency.

This is not impossible, of course. A mere $10K in Apple stock 20 years ago would be worth almost $5 million today. Buying Bitcoin or Ethereum just five years ago would have given you substantial returns.

People may remember the “meme stock” craze from just a few years ago with Gamestop and AMC. The whole internet was gripped with trying to ride the next big thing “to the moon.”

Let’s not even talk about the NFT nonsense.

Point is, everyone thinks stock investing = getting rich, except people who actually are rich. They know stocks and mutual funds won’t make you rich. They can make you financially secure. But if you want to become truly wealthy, you’re best bet is by starting your own business.

Think about it. Stock picking is unreliable unless you know what you’re doing. If you decide on the safer, diversified route of index funds, ETFs, or mutual funds, it could take decades to build anything substantial. It’s also highly unlikely you’ll break into the top 1%.

To get to $5 million, for example, you’d have to invest $18,000 a year every year for 40 years at an average annual return of 8%.

Wait, only $18,000 a year? That doesn’t sound too bad.

Well, according to the National Board of Labor Statistics as reported by USA Today, the average salary in the United States in Q4 of 2023 was less than $60,000. So, the typical person would have to stock away almost 1/3 of their income for basically their entire working life to get to that $5 million. That’s a pretty tall order considering they still have taxes and bills to pay.

—

This information may sound sobering, or even despairing. Especially to 401(k) and IRA maxers like myself, stock market junkies, or those in the FIRE (Financial Independence Retire Early) camp.

It’s important to keep some perspective. A $1 million net worth is still a lot more than most people will ever have. I’d argue you probably don’t even need half of that to retire, provided you manage your money well and are prepared to live modestly. And those are certainly attainable amounts for those who prefer the more traditional route of diversified index fund investing. Investing $3600 a year over 40 years at 8% gets you to a million.

But why cap your financial potential with just mutual funds?

What I’ve taken from this chart is that to become wealthy you’ve got to get creative and entrepreneurial. While I’m going to keep investing in stocks and my retirement accounts, of course, moving forward, I’d like to start thinking beyond them. I’m going to start allocating some of my income toward experimentation with businesses. This will prove a tough adjustment for me, as someone who’s never had his own business or been much of a risk taker. No doubt there will be some failures and surprises along the way. But I think it will be good mindset shift in the end, and hopefully a lucrative one, too.