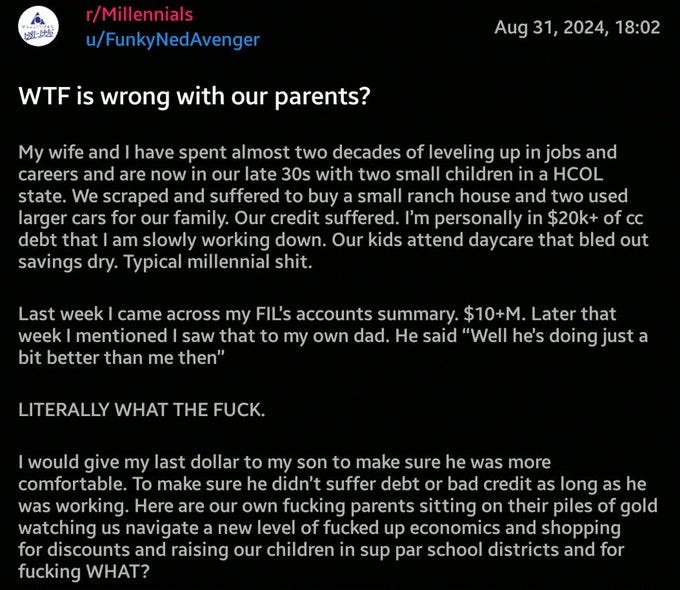

A post on Reddit took the internet by storm with a polarizing question.

Are rich boomers greedy assholes selfishly clinging to their lifelong gains, or prudent individualists responsibly preserving their wealth to endure the unknown storms of old age and life in general? Were they simply the beneficiaries of better economic times, cheaper cost of living, and a jobtopia American culture, who bootstrapped their way to financial security through their own gumption, or did they cruelly pull the ladder up behind them and say, “Suck it, kiddos!”

Are Millennials lazy, entitled brats looking for freebies from mommy and daddy instead of doing the hard work necessary to build their own lives? Or ar they the victims of “late-stage capitalism” and all its ills: high cost of living, obscenely high real estate prices, and high college tuition costs? Are Millennials truly just fucked by the economy they inherited from their boomer parents? Are they working their asses off and still getting nowhere through no fault of their own?

And what about Gen-Xers? Do they even still exist? Or did they all just become Millennials when grunge rock died?

I’ve been thinking about the screenshotted post above all week since I saw it reposted on X. I don’t generally puruse Reddit anymore, so I get most of my viral soap opera content from Musk’s Madhouse.

The post prompted a lot of feedback. Some outraged. Some insightful. Some hilarious.

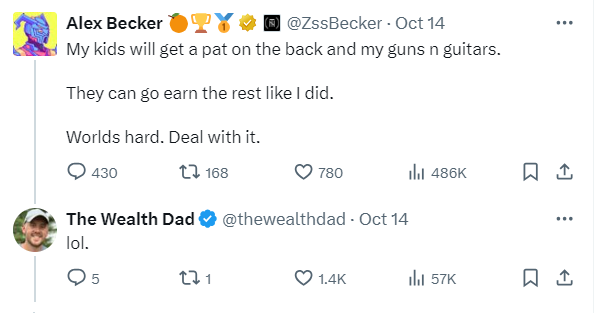

Here’s what Alex Becker had to say:

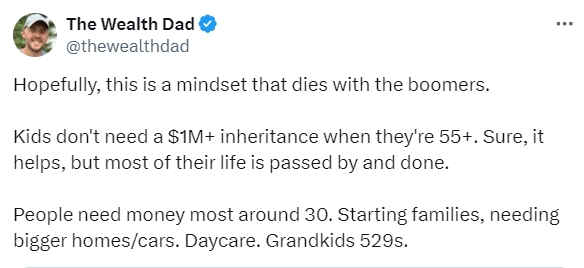

“The Wealth Dad” believes:

While others disagreed, and felt getting bags of money prematurely parachuted in from mom and dad would be a hinderance overall:

I don’t think anyone is entitled to anyone else’s money. Even their parents. Even if their parents are rich and it’s clear that when they die they are going to hand down millions, or tens of millions to their kids.

Are Millennials struggling these days? Yes. Many are. Are they having fewer children because of their struggling? Yes. Would a bailout from their parents help? Yes, it would. Money in your thirties, when many are building families or buying homes would serve much better than getting a bag of cash in your late 50s or 60s, after most of life has been lived. No doubt about that. And if rich boomers want to help, then by all means.

But let’s start with why so many Millennials are struggling today. For the most part, it’s largely due to student loans and real estate prices. And tons of bad debt. I myself had almost $35,000 of debt at age 30. Most of which was student loan related, but also credit cards and auto loans. I was truly fucked up. But unfortunately, I grew up in the lower-middle class, and while some extended members of my family, and ex-family, are quite well off, there was never anybody coming to lend me a hand.

I had to take the hard route. Packing up everything I owned in Philadelphia and moving to the frigid tundra of North Dakota. There, after some struggle, including brief homelessness and being reduced to one dollar to my name, I wound up securing a nice income in the oilfield. After two years, I had paid off all my debt, and built up a nice cushion of savings to finally go back to school and finish my bachelor’s degree. After checking off that box, I returned to work, and am now on the road to financial independence. I have zero debt, side income from investments, and basically have a “CoastFIRE” level networth. That means your retirement is secure via compound growth even if you don’t put another dime in of your own.

While I still have a ways to go until I’ve got that Holy Grail “Fuck you money” that everyone wants, I don’t think I’d have ever gotten off my ass and accomplished what I had if I thought mommy and daddy were going to help me out via inheritance or bailout. In fact, I’m way better off now than my parents are in retirement. I’m the rare Millennial who beat the odds and has done far better than his parents.

I rather like that. I like knowing I made it on my own without a handout. I won’t lie. Whenever I hear of Millennials who needed their parents to give them money for a house down payment, I look down on them. I think less of them. My mom and step-dad wouldn’t even fill out the FAFSA without giving me a hard time (a long story), despite apparently having “too much income” to qualify for it anyway. I paid for college entirely on my own. Hell, I moved out when I was 16. I did the best I could, fucked up along the way, but wound up course correcting big. On. My. Fucking. Own.

That’s not to say there have not been sacrifices. Real, killer sacrifies, on my part. For one, the oilfields of North Dakota is the place love goes to die. It’s virtually impossible to meet anyone up here. I had to sacrifice my prime dating years to pay off debt and secure my own financial future. Not an easy task, and not something every man is willing to do. It was very hard to try to have long distance relationships. It was demoralizing to make brief connections via dating apps, only to see them whither and die on the vine because of the distance, or because a girl I liked met someone else closer to her. Now in my 40s, I have to accept the fact that the optimal dating window has closed for me. Even if I am financially secure, that only goes so far once you’re past 35 as a man. I won’t accept garbage situations like single moms or women with baggage issues. I’ve never been sex-driven or needy or dependent on having a woman in my life. Again, a rare thing for a man. But then I’ve always been a loner and largely self-reliant. I was MGTOW before it was cool, baby.

I’d have loved to have met someone when I was younger and built a family with them. A financial bailout would have helped for sure. But what would have helped out a LOT MORE was the knowledge and training from my boomer parents about the perils and pitfalls of student loan debt, and some better financial education, overall. Both my mom and step-dad knew little about saving and investing, and so imparted no knowledge. I had to figure all that out on my own.

I think Boomers are highly overrated as “successful” or “lucky” because of the times they lived in. They had their own struggles, too. Be glad you didn’t have to worry about getting drafted into a war when you were a teenaged boy. My dad is a Vietnam vet. He joined the Army at 17 and later got sent over there in intel and recon. He was boots on the ground like the troops in Platoon. I’m very thankful I did not have go through something like that, and that all wars waged by our government since did not require a draft. I’m very appreciate and reverential of my father’s contributions. He is a war hero, and frankly, I’d be an unworthy asshole to act entitled to anything he earned from his Army pension or government pension due to his work as a probation officer for many decades. Same with my mom. She was in the Army also, and has worked as a teacher for many years, and gotten her own state pension and worked for her retirement. I love them both too much, and would much rather know they are secure in retirement than to think of them as piggy banks, to be used for my own needs. Again, maybe that makes me a rare kind.

Millennials have had opportunities that Boomers never did. The stock market has been far better, and more predictable, during our young adult lives than it ever was for Boomers. We’ve seen tech stocks like Apple 500X over the last twenty years. We’ve seen new asset classes like Bitcoin and crypto explode onto the scene. Broadband internet and smartphone apps have allowed us to navigate far more nimbly than landlines and payphones did for our parents. Real estate is way pricier in HCOL areas, sure. But the Midwest and South have offered cheap opportunities in areas that turned into boomtowns. The fracking boom saved my ass, and transformed West Texas and North Dakota into spectacular growth areas.

Even if you have rich parents, it’s never good to base your life on the idea that you’ll just get bailed out. At a certain point, you have to learn to rely on yourself. We’ve all met snobby trust fund pricks before. And we’ve all met helicopter parents who control every aspect of their adult children via money. Who the hell wants that?

Do some people have significant advantages from their parents because of money? Absolutely. But usually their success comes from their own intelligence and hard work. The money was just a tool. If I ever have kids, I’ll almost certainly leave something for them. But my real contribution will be to teach them how they can succeed on their own. Equipping them with the financial knowledge I never had. That’s a real inheritance.