Did my investment get an upvote?

Let’s face it, virtually every website nowdadays amounts to a doom scrolling time suck meant to extract your soul one qubit at a time.

(Qubit is a “basic unit of information” in quantum computing. You’re very welcome for a great Scrabble world.)

Of course, I know about random trivia things like quantum computing because I am an avid Redditor, and therefore am very smart.

Actually, that’s what Reddit should have called itself — “random trivia things.” What is a “Reddit” anyway? And why is an alien involved somehow? I’ve never been able to figure that out.

But speaking of quantum computers, I’d need one to calculate how many hours I’ve wasted on that website over the years. If you were to rank sites according to their “time suckage,” Reddit would have to be up there pretty high, right behind InstaGlam, Musk’s Madhouse (aka X aka Twitter), and Zuckerberg’s Personal Data Clearinghouse (aka Facebook aka Meta).

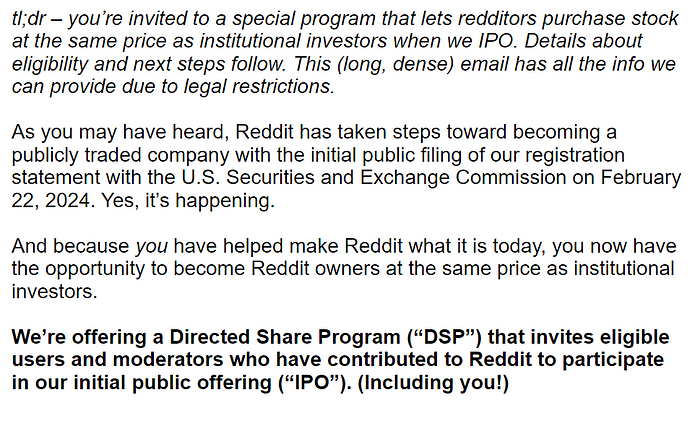

So, when I suddenly received an email one day from Reddit telling me that I, as a member, had the unique opportunity to participate in the site’s upcoming IPO, I of course jumped at the chance. Finally, a shot to claim some compensation for all the years I’ve blown on such subreddits as r/interestingasfuck, r/wallstreetbets, and r/explainlikeimfive. I’ve been on Reddit since the old days, when it was the nerdier Digg alternative, back in the late 2000s.

This was exciting.

What, you mean I get to buy a stock BEFORE the dirty unwashed masses do? I get to be an insider? I get to be treated like the elite intellectual artistocrat I am thanks to your website’s guidance? Sign me up, Reddit. It’s about time my contributions were richly rewarded.

Feeling like Warren Buffet, I took the first step. I won’t bore you with all the details about IPOs and the DSPs or the RMBs (that stands for Redditors Making Bank). But there were a few steps I had to follow after winning the golden ticket.

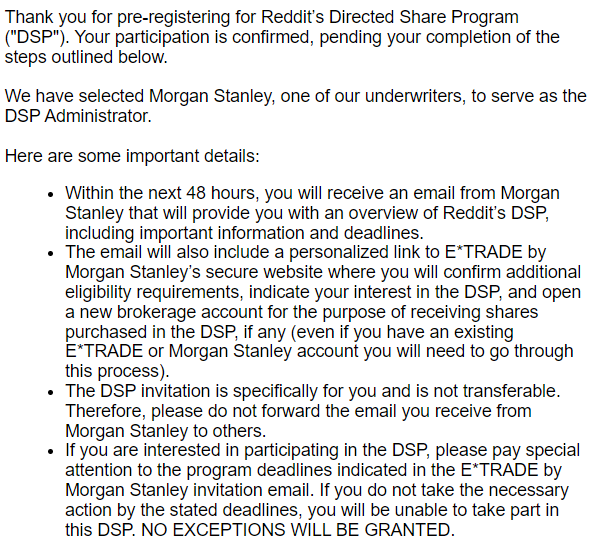

First, I had to pre-register for the IPO with Reddit by the March 5th deadline, and then wait to see if I was confirmed as a participant. As if I wouldn’t be. I expected to receive my confirmation in the form of a telegram or a gilded letter delivered by an owl at my window. Instead, on March 11th I received just a simple email stating that I was confirmed.

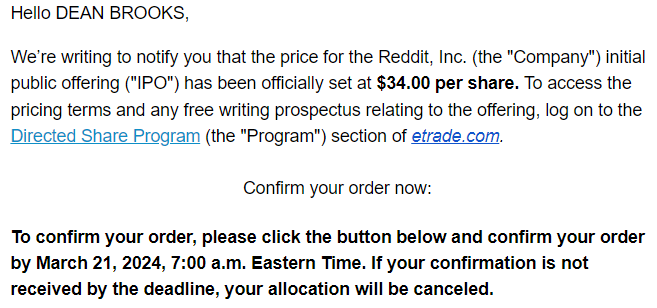

Next, I had to set up a separate brokerage account just for the IPO. I’ve been with Morgan Stanley/E-trade for almost ten years now so this was an easy process. After getting a new account going, Morgan Stanley emailed asking me to confirm my order and deposit the necessary funds. Again, just an email. No complementary top hat or secret invite to an Eyes Wide Shut sex party in Bohemian Grove. So much for feeling like an elite.

$34.00 seemed cheap but reasonable. Facebook debuted at $38. Uber at $45. Tesla started at $17. I generally only invest in index funds or ETFs like SPY, VTI, VOO, and QQQ, so I was used to stocks costing in the hundreds. Generally, for my individual brokerage account, I deposit $1000+ into my investments at a time. But this was an exciting albeit risky tech IPO based on a website famous mainly for fostering neckbeard outrage and degenerate Wall Street gambling. I decided to buy just 10 shares, and put in $350 to ensure the whole cost was covered should there be some small additional fee.

So, how’d I do? Right after Reddit launched on the NYSE on March 21 the stock nearly doubled to about $65 a share. It dipped to around $39 in mid-April before rising back up to $62 just last week. And as of now, at close on May 24th, 2024, it’s $54.72.

When Reddit’s stock (RDDT) hit around $56 earlier this week I sold five shares for about $280. The reason for that was I wanted to pull out nearly my initial investment ($340). That way going forward what I have left at stake is almost all profit. If Reddit continues to move up, I capture the upside. If it crashes down and ends up floundering, at least I’ll have just about broken even and not really lost anything.

In summary, participating in Reddit’s IPO was a fun and thus far profitable experience. Do I wish I had invested more into the IPO? In retrospect, of course. Dropping $10k in there would have put me up almost $16,000 before selling half my shares. But a big part of investing is risk mitigation, not just seeking out a high return. Reddit’s IPO could have been a big fat flop to start off. And who’s to say Reddit won’t get downvoted by investors eventually?

I don’t know how long I’ll hold onto my five remaining shares. Facebook went up 5x in the first six years after its IPO. It’s now up 12x. But then Uber is barely up 50% from its IPO price in 2019. You’d have done better just holding the S&P 500 than Uber over that same time span. Will Reddit even still be popular in ten years? That’s difficult to say. The internet is a fickle place. I know I’ll (probably) still be there.