These stupid fees are getting out of control anymore.

A few days ago I received a notice from my bank that the terms of my checking account are changing soon. In the bank’s own words:

A $15 monthly account fee will be charged, unless you maintain a $5,000 average monthly account balance¹. The first monthly fee will be charged on November 30, 2024 for monthly balances held during the month.

I’ve been banking with this place for over six years now. I use my checking account almost exclusively through them. I also have two of my IRAs, two personal brokerage accounts, and a savings account. Altogether, I have a six figure amount combined just with this one financial institution.

Previously, all I needed in order to avoid a $15 fee was to meet any of the following criteria:

You had set up a direct deposit of $200 or more per month to your account.

You maintained a $5,000 average monthly balance in your account.

You maintained a $50,000 average monthly balance in any of your linked (name of bank)) account(s).

You had a combined $50,000 or more in linked (name of bank) from (name of bank) brokerage accounts.

You had executed 30 or more stock or options trades during the prior calendar quarter in your linked (name of bank) from (name of bank) brokerage accounts.

The above criteria is not hard to fulfill, especially if you have direct deposit. However, the new rule that requires a minimum of $5,000 is stupid, ridiculous, and feels petty.

Now, I usually maintain $10,000 minimum in my emergency savings. My liquid savings can fluctuate between that and $20,000 or higher. It’s not that I can’t meet the criteria. I can. It’s the principle of the matter.

Many others also won’t be able to meet that minimum, and will now be forced to bank elsewhere.

I’m fortunate to be in a solid financial position now. It wasn’t always the case. I remember getting constantly hit with overdraft fees when I banked with Wells Fargo years ago. These fees started at $35, but would balloon even higher if you had multiple charges stacked up. Which I sometimes did because I was so broke at the end of every month. There were days where I’d end up with a negative account balance. Do you know how hellishly frustrating it is to get paid one day, only to end up negative the next, all to be told by customer service that Wells Fargo’s fees are done as a “courtesy?”

Wells Fargo is well known for being a greedy pile of shit. The CFPD recently fined them $3.7 billion for widespread malfeasance. They’re part of the reason I swore off brick and mortar banks for good years ago and switched to my current bank.

I like my current bank for the most part. I can easily check all of my accounts on one screen. Their customer service has largely been good. They offer other benefits, including ATM fee refunds and no foreign transactions fees if made with my debit card. I’m not planning on switching to somewhere else just because of a stupid $15 fee.

But it’s pissing me off becaue I know my bank is likely making a KILLING off of me. My savings account currently earns a paltry 4.50% interest rate, while my checking pays 3.0%. That’s not too bad. It’s certainly way better than Wells Fargo with its absurd 0.01% interest rate for a “Way2Save” Savings account. Way to save? More like way to lose.

Good God, fuck Wells Fargo. Seriously.

Banks don’t just do nothing with your money. They lend it back out, of course, in the form of mortgages, business loans, and credit cards. All with interest rates that are way higher than 4.50%.

That’s only the beginning. Due to the fractional reserve lending system, banks can lend out your money while only keeping a small portion on reserve. Banks used to have to keep a certain amount in reserve. Then in March, 2020, the Federal Reserve reduced the required reserve ratio to 0%. Thanks Covid. Theoretically, my bank could lend out my entire $10,000+ that I’ve deposited in savings. If they’re charging an average of 10% or more on interest annually, that means my bank is making $1,000 off of me every year, not counting additional fees.

Then there’s the data. Evey transaction your make with your debit card represents valuable information to market research companies. Info that your bank and other places you do business with could sell for big money. Data = gold in today’s economy.

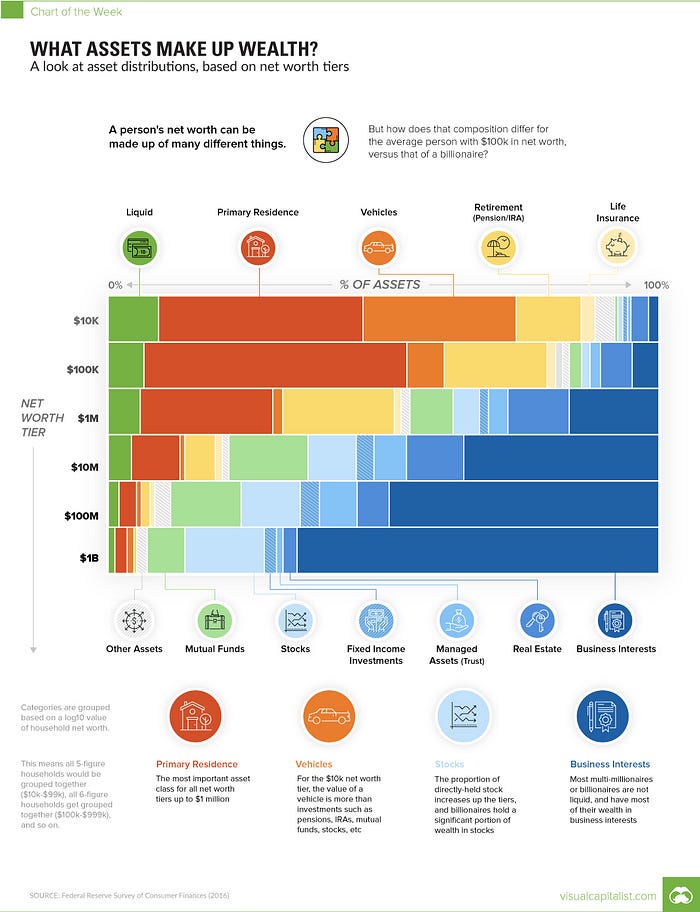

Point is, as a customer with a bank, you are an unwitting ASSET in their portfolio, either through your deposits, or with the spending data and other types of data you represent. And if you have significant holdings than you are especially valuable to a bank.

Bottom line: My bank should be paying ME $15 a month for the privilege of my continued loyalty. Likely they’ve made thousands off me over the years. Maybe even tens of thousands. I’m a net positive customer. And what do I get for my trouble? A $15 fee just for having a checking account.

To quote Ice Cube, “This is the motherfucking thanks I get?”