An end-of-year look-back at my crypto investments, and a 2023 look-forward. Is it worth HODL’ing to infinity? Also, some price predictions.

2022, we gotta talk, man.

What the hell happened? You were supposed to be the year cryptocurrency went super mainstream. The year where everything that wasn’t dirty, dirty fiat went to the moon, baby.

Instead, we crash landed in Death Valley. Celsius and BlockFi went bankrupt. FTX imploded, causing thousands of investors to lose access to their funds. TerraUSD and LUNA completely evaporated, taking billions with them.

And instead of Bitcoin crossing the much ballyhooed $100,000 threshold and putting a Lambo in my garage, it’s ending the year below its 2017 high-water mark.

What am I supposed to drive now, 2022? A freaking Toyota? GTFO of here!

Man, what a terrible year for the crypto asset class.

(Disclaimer Side Note: None of this is financial advice. I am not an investment professional. This is mostly a humorous gut-checking look at my crypto stack and the future of crypto, than some serious chart-analysing deep dive. If you want a pro’s opinion, go check out ClearValue Tax on YouTube, which is where I get a lot of my info. And do your own due diligence too, of course.)

Like most people, I got burned badly this year in the crypto space. But rather than wailing and whining, I thought I’d take a sober look at the wreckage. Throughout the year, I did sell some of my holdings, while keeping some others.

But even if I dumped some of my coins, that doesn’t mean I’ve lost faith in the asset class. If anything, I think all the chaos will make the space much stronger. Crypto needed a wake-up call. Investors of all stripes, amateur or otherwise, needed a wake-up call. With the Federal Reserve now rapidly raising interest rates, the era of easy money is over. For now. Investments have to really prove themselves, rather than just offer some potential speculative future gains.

So what does the current crypto winter mean going forward? Should you just HODL ‘till the cows come home, or cut your losses, and move on in life?

I think the answer is somewhere between the two extremes. For sure, some crypto assets are dead and may never come back. According to ClearValue Tax, my go-to for crypto answers, many altcoins from 2017 failed to regain their former highs in the 2021 bull market run. So just because some alts are down big now, doesn’t mean that in a future bull run they’ll make all-time highs again.

I think overall this recent crypto crash should prompt a return to the fundamentals. Even if many alts might promise exponential gains, how do you know which ones will survive through the crypto winter?

For me, I’m going to stick with Bitcoin and Ethereum, and maybe an alt or two going forward into the next run. Luckily, I was mostly loaded up on those two in the beginning anyway. So for me, not much is going to change. It’s all about HODL’ing through the pain.

For sure, it sucks seeing an asset you hold plummet by double-digit percentages over the course of a year. But if you’re planning to hold long-term, this latest “setback” is really a huge buying opportunity.

Bitcoin and Ethereum may drop more from their current levels going into 2023. In fact, I wouldn’t be surprised to see Bitcoin drop to the mid-teens to even as low as $10,000. I could see ETH hitting $600-$800. But long-term, I think these assets still have a lot to offer in the way of gains.

So, here are my Very Crude, Very Amateur Predictions

I think Bitcoin will rise somewhere between $80,000 and $120,000 sometime in the next bull run. Possibly late 2024 into 2025. After the next halving event (roughly around March 2024) and assuming the Federal Reserve pivots from hawkish to dovish. If Bitcoin first falls to $10,000, that means you could possibly be looking at an 8x-12x if you time your purchase and sell points right.

For Ethereum, I think it will rise to somewhere between $6,000 and $10,000 at around the same time. If it first falls to $600, then you could be looking at a potential 10x or greater if you time the bottom right and sell near the top.

Regarding altcoins, DeFi, DEXs, CEXs, etc. I have no freaking clue. I’m very much a crypto minimalist. I get my coins off exchanges ASAP, and hold everything in cold storage. Part of what appeals to me about cryptocurrency is the decentralization and self-custody aspect. But therein lies some danger. You have to be extra careful guarding your own stack.

I’m proud and lucky to say none of the exchange nonsense impacted me. I did briefly hold some Bitcoin and other assets on BlockFi earlier in the year. But even then, I kept hearing negativity regarding that institution. And BlockFi kept reducing its yield anyway. It didn’t seem worth it give my coins to someone else to hold for such a little payoff. So sometime around the end of last winter I pulled everything I had off BlockFi, and into my own cold storage wallet. A decision that’s paid off very well.

If an exchange, central or otherwise, is offering ridiculous yields that look too good to be true, they probably are. Stay away. I’m glad I trusted my gut regarding BlockFi. And while I never used FTX, when I kept seeing a bunch of random celebrities and YouTube crypto dorks shilling for it, my B.S. detector went off. I didn’t know why. I just didn’t like the vibe that exchange put off, much less its supposed “man of the people” founder. I don’t have some sixth sense or a crystal ball. It’s just I’m old enough to remember institutions like Lehman Brothers, WorldCom, Enron, and the numerous amount of Dot Com failures that blew up in the 2000s. Common sense told me something wasn’t right.

Hey, maybe this getting older thing has some advantages.

With all that said, here’s a more microscopic look at some of my crypto HODLings, starting with the biggest one of all.

Bitcoin (BTC)

I first started buying Bitcoin back in September, 2020. Slowly, tentatively, without really knowing what I was doing. But the more I learned about the digital decentralized store of value, the more excited and enthralled I became about its future. Even if I didn’t fully understand the technology behind Bitcoin, I understood its unique and revolutionary characteristics.

Then when the bull run began, fueled by the Federal Reserve money printing into oblivion following the Covid market crash in March, 2020, I felt vindicated. Though I’m proud to say I never got into the laser eyes craze, which felt stupid and cocksure to me.

I only bought $25 worth of Bitcoin that September, when it was valued around $10,000. Then slowly I accumulated more through the end of the year, and aggressively ramping up more into the bull run. By the time it hit around $25k-$35k in the first quarter of 2021, I’d already doubled or even tripled my investment. Bitcoin had a double top in 2021, hitting near $69k twice, and crashing almost 50% in-between. But since November of last year (2021), it’s been almost all down hill, and now it sits somewhere between $17k and the abyss. If the Fed keeps jacking rates, and the economy spirals into a recession, Bitcoin could crash even lower.

But I’m still accumulating and holding. And now is the best time to do so, hard as it may be. When the price is low, and everyone else is saying it’s dead and never coming back. Not in two or three years when it’s making all-time highs again and crypto bros are mortgaging their houses at $80k a coin, and posting YouTube thumbnails of their stupid faces and their stupid mouths wide open.

I believe in Bitcoin. But I wouldn’t say I’m a fantatic or evangelical about it. And I don’t buy into the moon shot price predictions that so many mouth breathing YouTube dweebs like to make. My plan is take advantage of the bear market over the next two years (or however long it may last). When I first started buying in fall 2020, I felt like it was too late. I missed out on buying when Bitcoin dropped to around $5000 during the covid crash because I didn’t see it for the deal it was. But next time I intend to take advantage of major price drops more, and then sell more into strength once the bull run starts up again.

Ethereum (ETH)

ETH has actually been my most lucrative crypto investment. I started buying this one in December, 2020, and have held since. I’m still up about 2x to 3x on my holdings, even considering I bought some at the tail end of the bull run.

Even though ETH’s been a good investment, I still have doubts about it as a long term value, given the collapse of FTX and many other crypto exchange firms. Not because I think ETH will collapse like those firms, but because unlike Bitcoin, it’s not adequately decentralized. So, it goes against the whole ethos of “crypto” in general.

ETH is also buggy and expensive to use, unlike many other competitors. I compare it to Microsoft Windows in the ’90s, when despite it being slow and awkward, it had such enormous market share that everyone used it.

However, ETH will most likely continue to be used well into the future. It has the distinction of first mover advantage, which, in the tech world, is often enough to secure a stronghold for years to come. Ethereum is the foundation for many DeFi and NFT projects, and I don’t see that changing anytime soon. At this point, whatever supposed “ETH-killers” come out, they’re really competing for third place or worse.

So, my plan with ETH is pretty much the same as Bitcoin. Keep HODL’ing, and keep stacking. I missed out on loading up on ETH at its ridiculously low bottom during the Covid crash — something I regret not doing. I still say there is downside to come. So next time I’ll be more ready to deploy capital and swallow the risk. But to be clear, it’s riskier than Bitcoin, and Bitcoin itself is already far out on the risk curve as far as investments go.

Polkadot (DOT)

While BTC and ETH will likely remain in the number one and two spots in terms of market cap and utility for the forseeable future, the question that remains is who’s going to place in the #3 spot and down?

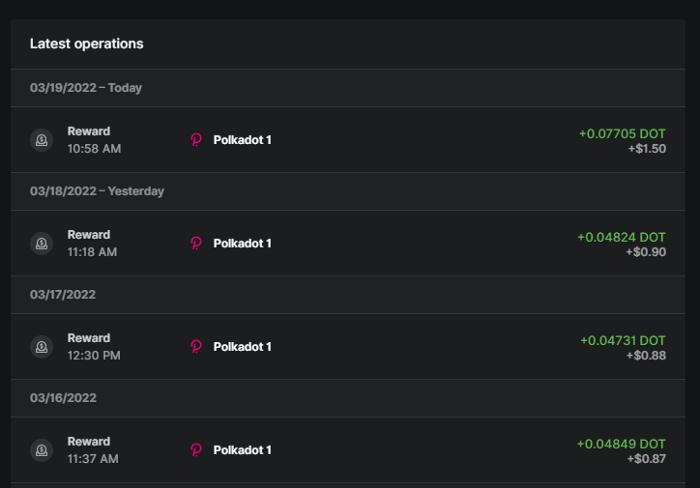

Polkadot is an altcoin I started buying sometime in 2021 into early 2022, but eventually offloaded in favor of more BTC. In fact, I wrote about it in this article here.

DOT has some positives going for it. It’s supposedly meant to act as a bridge of sorts, linking other cryptocurrencies together via use of its native token. Its founder is Gavin Wood, who also co-counded ETH with Vitalik Buterin. DOT also has a good number of developers. It offers high-yield for staking the token, which you can do on your own wallet or on an exchange like Kraken. The downside is that DOT has an unlimited supply, and an effective infinite inflation rate. DOT may pay out between 7% and 14% (or higher), but it has to, because its current annual inflation rate is about 7%. Token inflation kind of goes against the whole philosophy underlying crypto, particularly Bitcoin, itself. Inflation is what fiat money does all on its own. And God knows we’ve seen enough inflation in 2022 to last a lifetime.

At this point, it’s really a guessing game as to what token will be able to compete alongside ETH in the future. I highly doubt anything will beat ETH at this point, even if a coin is cheaper and easier to use. I may return to DOT in the future now that it’s fallen to it’s near-ICO price (sub-$5). I may even stake it again on my Ledger, which for newbies is not the easiest (or risk-free) thing to figure out.

DOT could be one of those rare alts that make higher highs in the next bull run. Which would provide enormous returns considering its present price. But there are still just too many questionable elements. If it keeps dropping, however, and gets to the $1-$2 level during a potential capitulation crash next year, I may decide to stack some again. For now I’m staying away.

Algorand (ALGO)

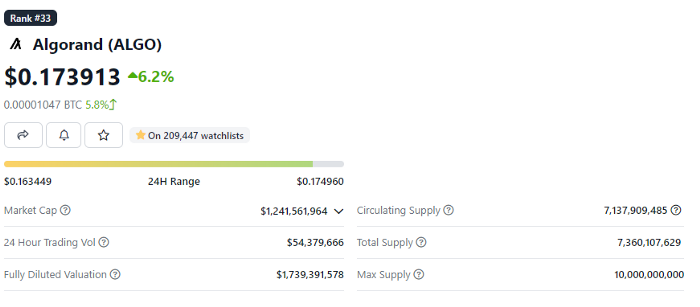

Ugh, this one was a big disappointment that once held some promise. While it may still technically be a “blue chip” alt, it’s fallen out of favor pretty hard, like many supposed “ETH killers.”

Despite its current state, I actually did okay with Algo, initially buying some up in 2021 when it was around $.30, watching it pump to over $2, before plummeting back down to earth. Like DOT, this is another alt competing to at least get into the same ball park as ETH. It has some MIT-trained founders, and a development team. It also had a very easy staking feature. All you needed to do was put it on your wallet, and you’d get daily gains (around 4% annually). I liked the simplicity of it. It was one of my first alt coin “wins.” I did okay, but sold most of my small stack well below the high.

This is another alt I may buy into if it drops hard enough, like DOT. I’m not into meme coins. I don’t do DeFi. I no longer trust exchange tokens, no longer how established they may be. For me, I look for a strong development team, utility, and other fundamentals. Algo has some good things. But its glaring weakness is its max supply, which is ten billion. While that’s better than DOT’s potential infinite supply, that’s still hardly a scarce amount.

Algo still has a lot of questions. But like DOT, it could be a survivor into the next bull run. So I’ll keep my eye on it and may reacquire if it drops low enough.

PancakeSwap (CAKE)/Uniswap (UNI)/ApeSwap (BANANA)/DeFi in General

I only dabbled with DeFI and its various outrageous (and childish) forms. Yes, I see the potential. No, I don’t really care. At least not anymore. And that’s because for all the research and experimentation I did, I still don’t really understand it. And it’s riddled with scams.

I think at most I put a few thousand into the DeFi space. I even made some small gains. But because I just never really got the tech behind it, I ultimately pulled out. Even if an asset space is new and looks promising, I don’t think it’s a good idea to get into it if you don’t grasp it. This is why I avoid penny stocks, most tech stocks, or investing in anything that’s too cutting edge. I like some risk, sure, but I’m not a pioneer.

Still, it will be interesting to see how this space matures in the future. I don’t know that I agree with the idea that DeFi is the “future.” Just because trust is such an important aspect of the financial world. Banks, whether you like them or not, have been established for thousands of years, have government backing, and in 99% of cases, work just fine. Ask the millions who use them for mortgages, car loans, and to store their savings. Banks ain’t going anywhere, buddy. And if DeFi never matures beyond desserts and fruit-themed tokens that crash more than 95% during bear markets, it probably won’t make it beyond the sidelines in the finance world.

Conclusion

This look-back actually encompasses 2020–2022, not just a single year. But it’s been a long time coming. And now that crypto winter has clearly set in, it was time to look at my holdings and think about the future.

2023 going forward will be all about fundamentals, and priorityzing Bitcoin and Ethereum over pretty much everything else. I see those two as the “safest” bets in terms of crypto, that still have a lot of runway. The way I see it is this: Would you rather have a good chance at your investment making an 8x-12x? Or a much smaller chance of your investment 20xing or more by going into a riskier altcoin? I’ll stick with the “smaller” but more likely return. It’s easy to lose sight of the big picture and appreciate the potential gains in the crypto space. A good diversified S&P 500 Index Fund will generally make 8%-12% a year. An 8x-12x on a few virtual coins in a few years is quite frankly a ridiculous ROI, and trying to get more than that is just asking for trouble.

Another lesson I’ll take with me moving forward is keeping a better eye on the exit. It’s nice to learn about new technology, and seeing where all this crypto could lead to in the future. But in the end, it’s an asset like anything else. Not a religion. Not a philosophy. I’m here to make money, not change the world. Had I sold my Bitcoin and Ethereum holdings late last year in 2021, I’d be sitting on a pretty good down payment for a nice house. As it is, I’ll have to wait for the next bull run. But my “mistake” of HODLing through the peak, and my patience, may potentially get rewarded, if the Fed and the economy ever gets itself sorted out. The next peak could be way bigger.

We’ll see where things go in the new year. One thing’s for sure. I’m looking forward to 2023 and beyond. 🙂